On October 31, 2008, an anonymous entity under the alias Satoshi Nakamoto published the white paper that sent shockwaves across the financial ecosystem, threatening to change the paradigm, once and for all. The work was entitled, Bitcoin – A Peer-to-Peer Electronic Cash System.

It was the dawn of Bitcoin revolution

The thing about Bitcoin that scares banks, lawyers, and the public notary is the global monetary decentralization.

In other words, with cryptocurrencies such as Bitcoin, there is no more need for the classic middleman. Central banks and commercial banks, in general, are losing their influence. We don’t need them anymore. The fee they are usually taking from every single transaction now goes to the people. To you and me.

But what gave Bitcoin a monetary value?

What gives value to money? Or gold, for that matter?

Faith. People’s faith. In other words, if enough people believe that something has the value, it can, therefore, be in use for the exchange.

You can’t eat money. You can’t cover your ass with it during cold nights. Yet, you will kill for it. In fact, you can’t survive without maintaining the large-enough number on your bank account. Add the fact that just a quantum of all the money we have in the system is in a paper form, and there you have it.

When you think about it, it was the banks and governments that enabled the birth and rise of cryptocurrencies and Bitcoin respectively. Their tendency to control the money by moving it in a digital sphere created a fertile ground for the next step in the evolution of the market system.

In reality, there is no real difference between Dollar and Bitcoin, other than a fact that Bitcoin comes in a maximum allowed, predetermined number of units.

Both predominantly reside in a digital form and people believe that both can buy something.

The only major difference is that cryptocurrencies are rendering banks obsolete.

And not just the banks. Bitcoin, Ether, Ripple, and any other cryptocurrency will eventually kill every traditional “middleman” in a transaction process. Banks, lawyers and the public notary offices will be removed from the transaction confirmation process altogether. It’s gonna be the miner who validates a transaction.

How?

The paradigm of Bitcoin and every other digital currency is simple:

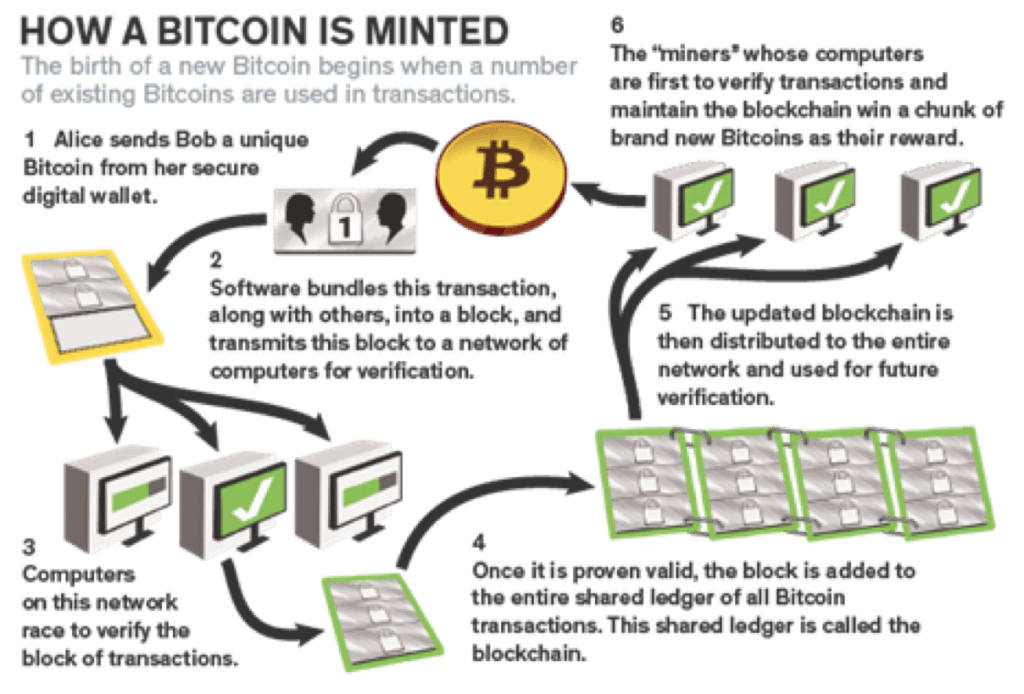

He who confirms the transaction earns a fee.

So far, that was the role of the bank in monetary transactions. With cryptocurrencies such as Bitcoin, that entity can be anyone willing to spare some computing power on a blockchain process.

In simple terms, through the process known as the “mining,” you earn a small compensation.

How’s Bitcoin then different from what we have right now?

Imagine a game of Monopoly. The common practice is that one player is always the “bank.” In other words, there’s someone who’s controlling the money and confirming the transactions to prevent “double spending” or the situation where the player would attempt to pay two or more things with the same money.

That’s exactly how things work in the real world. Every transaction needs to be confirmed by the “independent” third party. And for that service, the “regulator” is awarded a juicy fee.

Today, you can’t make the simplest deal without confirming it with the lawyers or public notary. You can’t pay something without losing a percentage due to the fees banks are charging.

But the real issue is the time it takes for the bank to confirm (process) the transaction.

2-5 business days, not counting Saturdays, Sundays and other non-working days. What’s that all about? What happens to the money you sent during that time?

They are playing with it on the market, trying to multiply it and make additional profit.

In reality, there’s no need for the entire confirmation process to take more than a second because once you hit the “PAY” button, everything happens at the lightspeed. Simply put, before you even blink, the money is already in its final destination. At least it should be, given the technology.

But they halt it on purpose. And then charge a fee for such blatant inefficiency.

Bitcoin and blockchain technology respectively changed that at its core.

In other words, you get your money immediately after the confirmation process is over and that takes anywhere from a few seconds to 20 minutes, depending on the mining difficulty. In addition, the fee you’re gonna pay to the network is only a quantum of what the banks are charging.

Thus, Bitcoin makes the process A) faster, and B) cheaper.

And then they wonder why people embraced it so fast…

But it’s not just the money transactions.

Bitcoin paved the way for the application of the blockchain technology on every contract made between two or more entities.

Ethereum is the pioneering blockchain technology mainly oriented to the contracts. The core of the technology is the original Bitcoin blockchain.

Simply put, with Ethereum, two entities are confirming the contract automatically – without any need to waste time and money going to a lawyer or public notary.

The process of confirmation remains the same. The peer-to-peer-network confirms the transaction (signing of the contract) almost instantaneously while charging a close-to-insignificant fee.

In other words, every legal contract is executed almost immediately with the insignificant loss on account of the processing fees – all thanks to Bitcoin, the original cryptocurrency.

Now when you know the details, are you still wondering why people are interested in acquiring cryptocurrencies?

And, if you’ve been wondering whether or not to invest in Bitcoin, for example, maybe this will help.